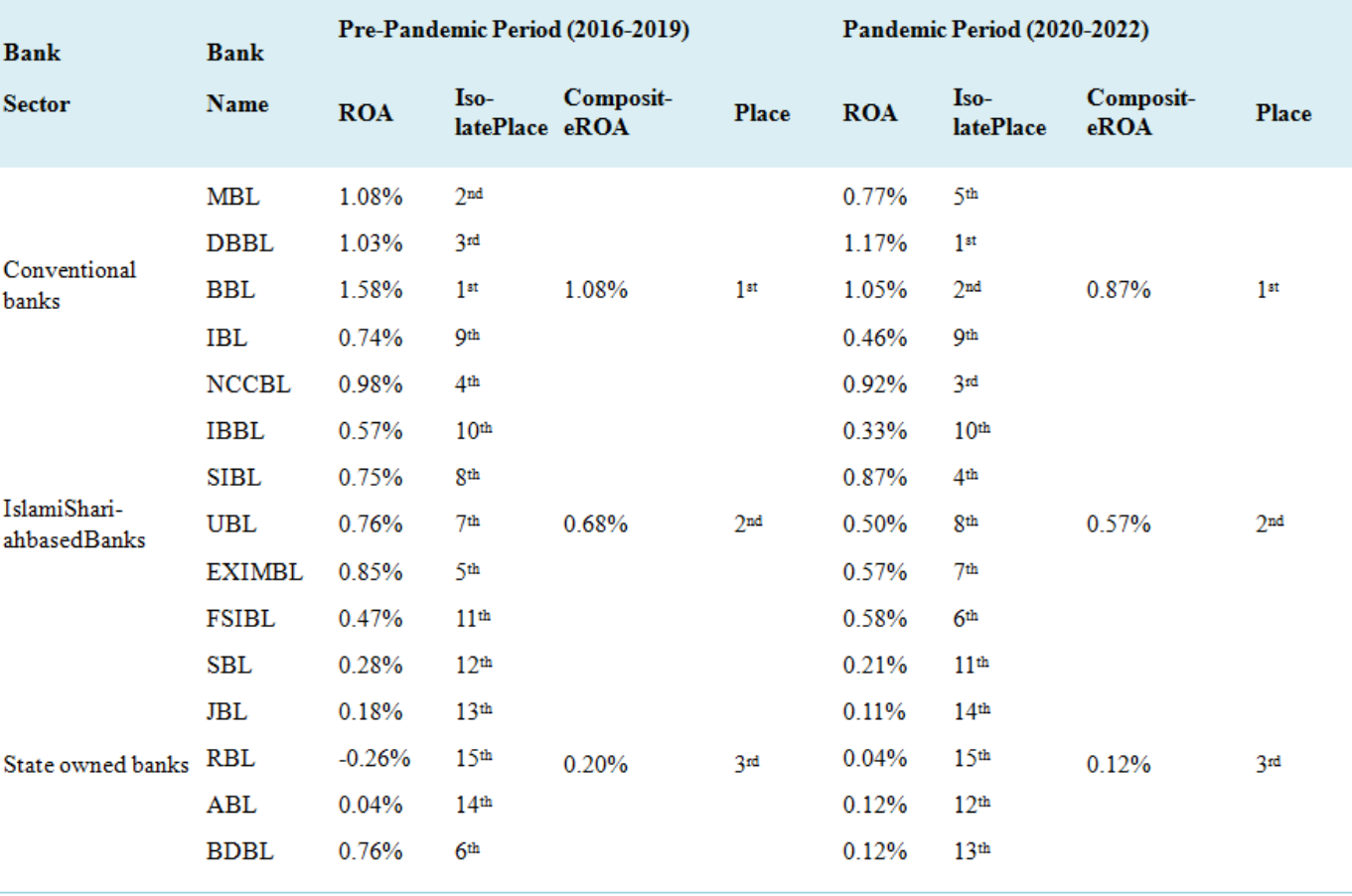

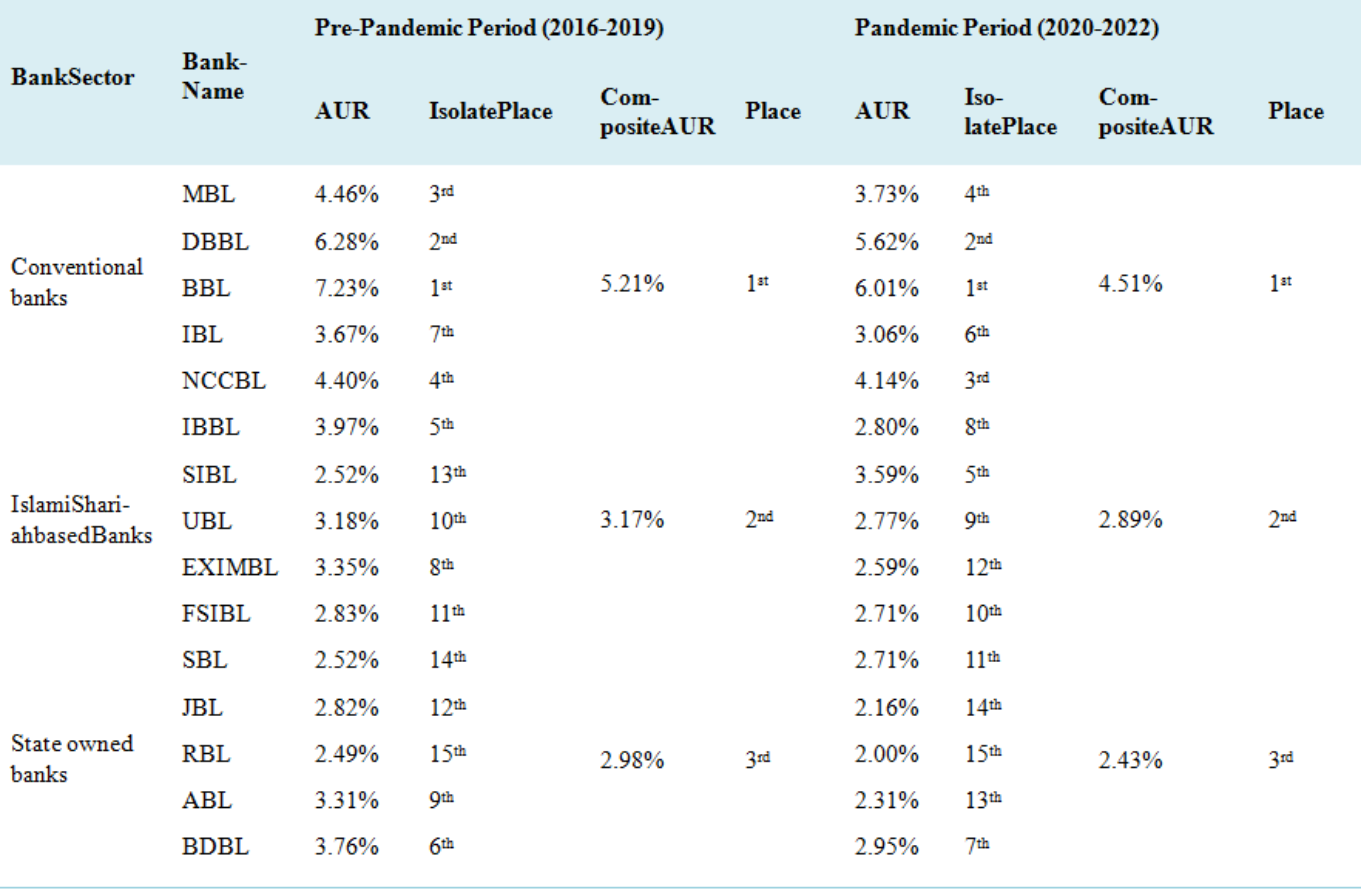

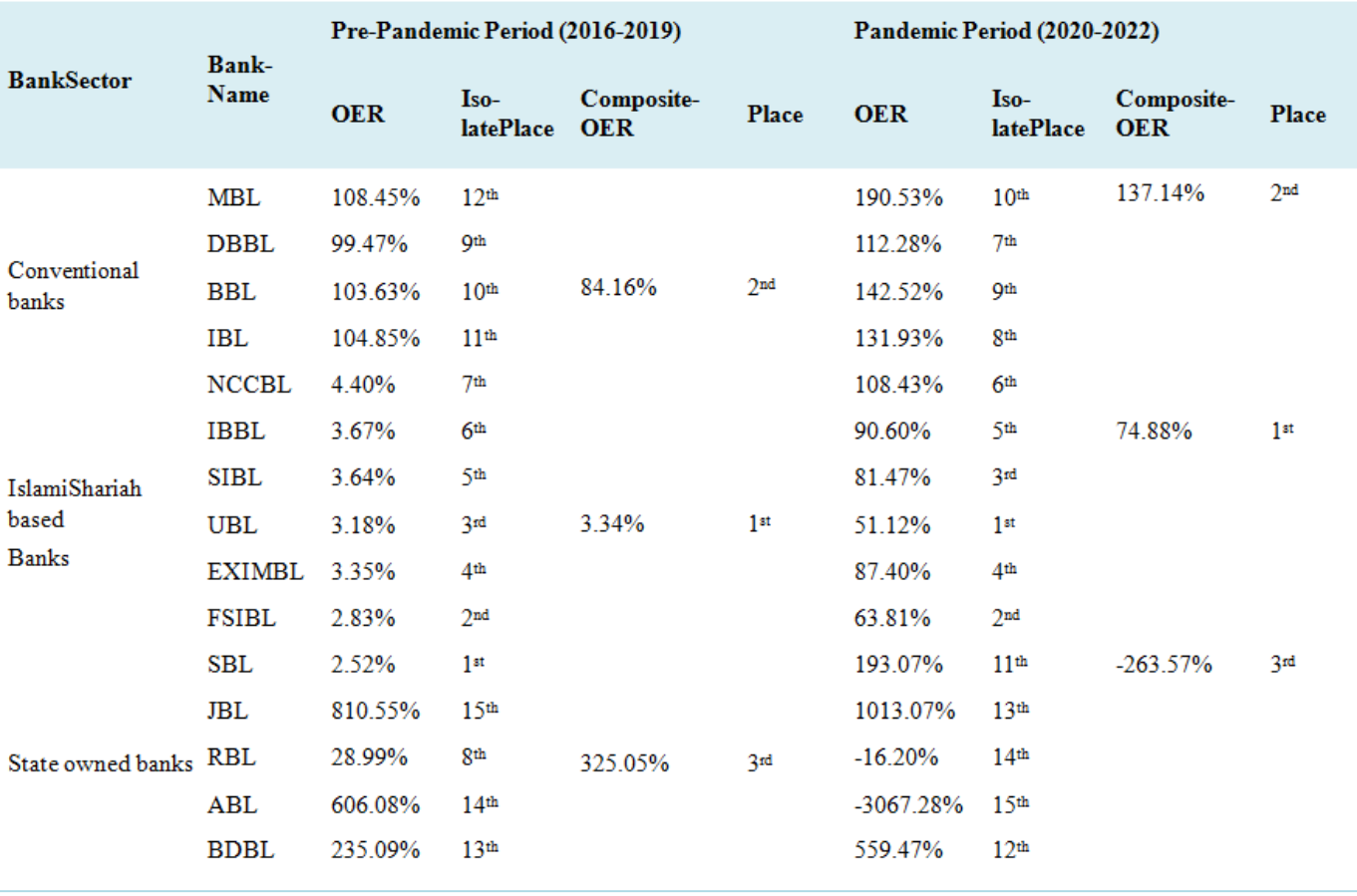

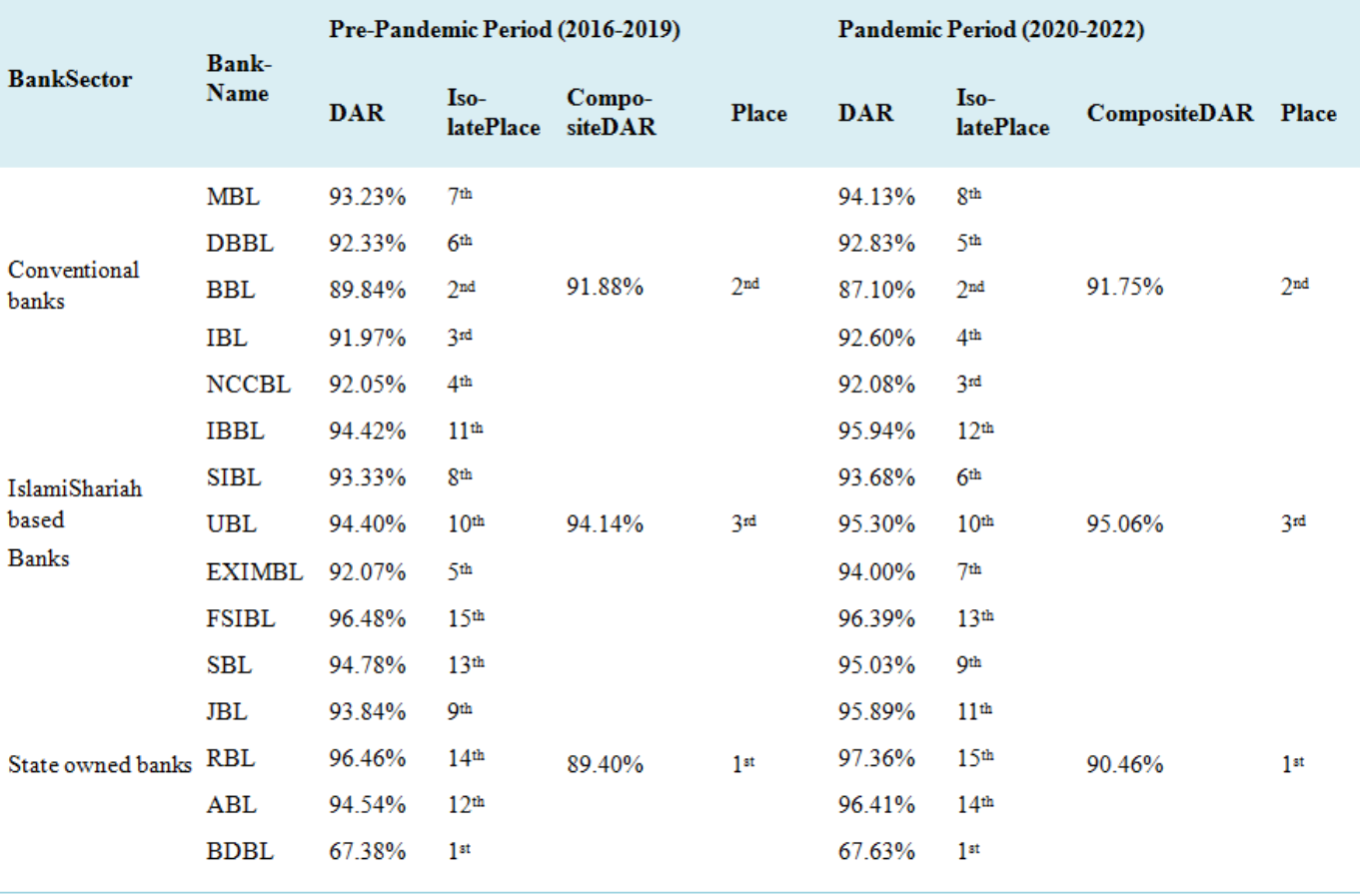

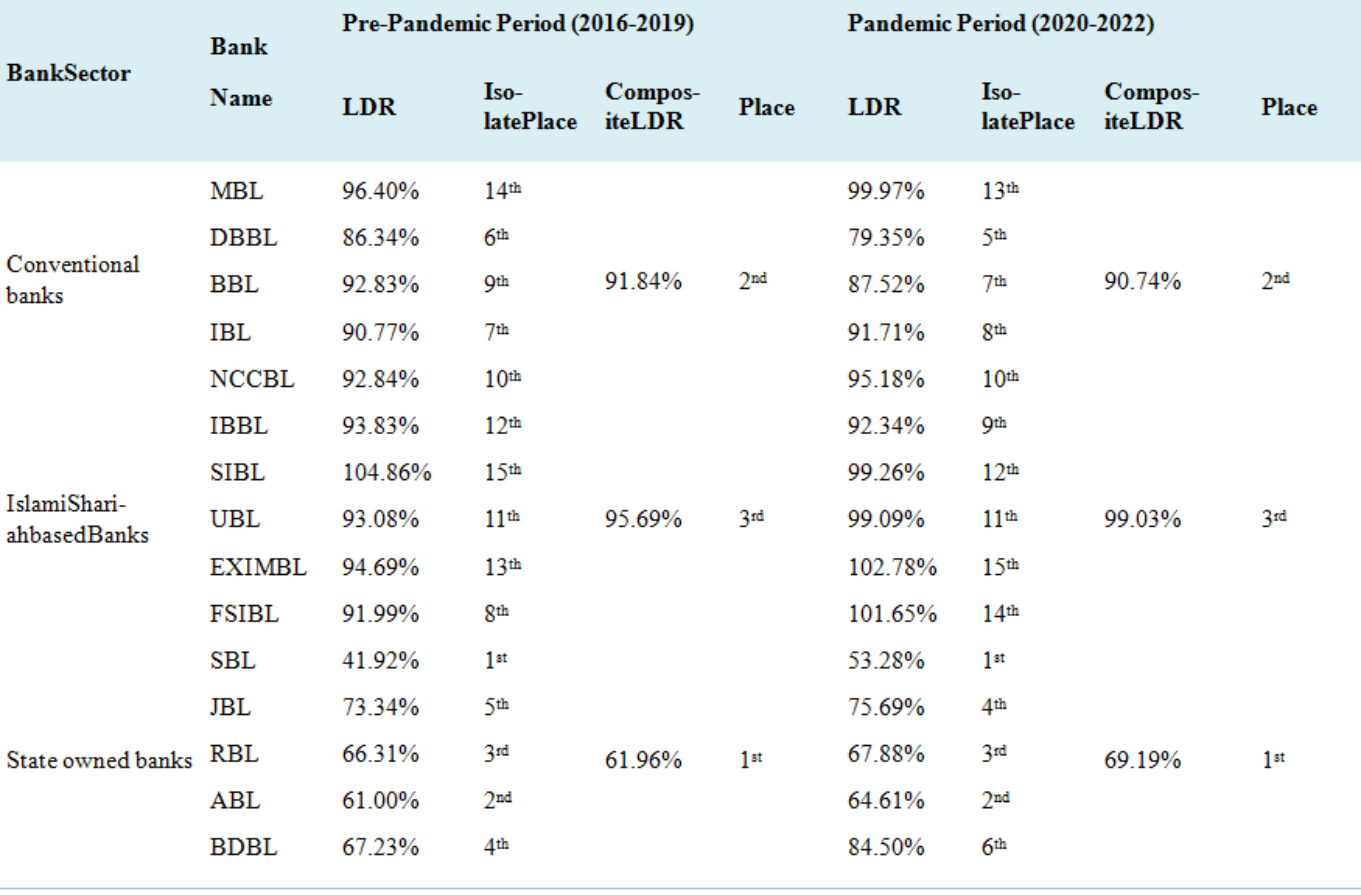

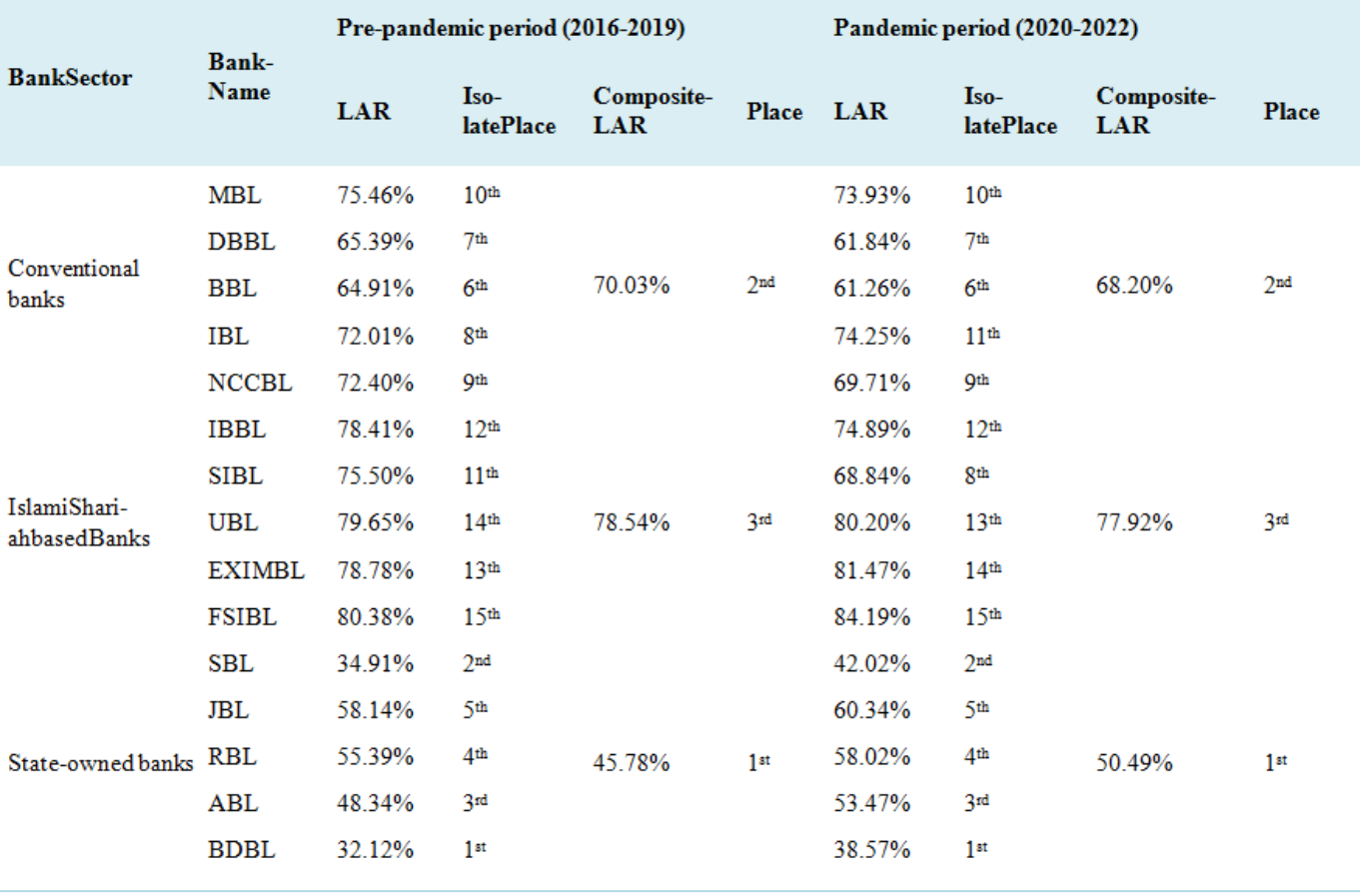

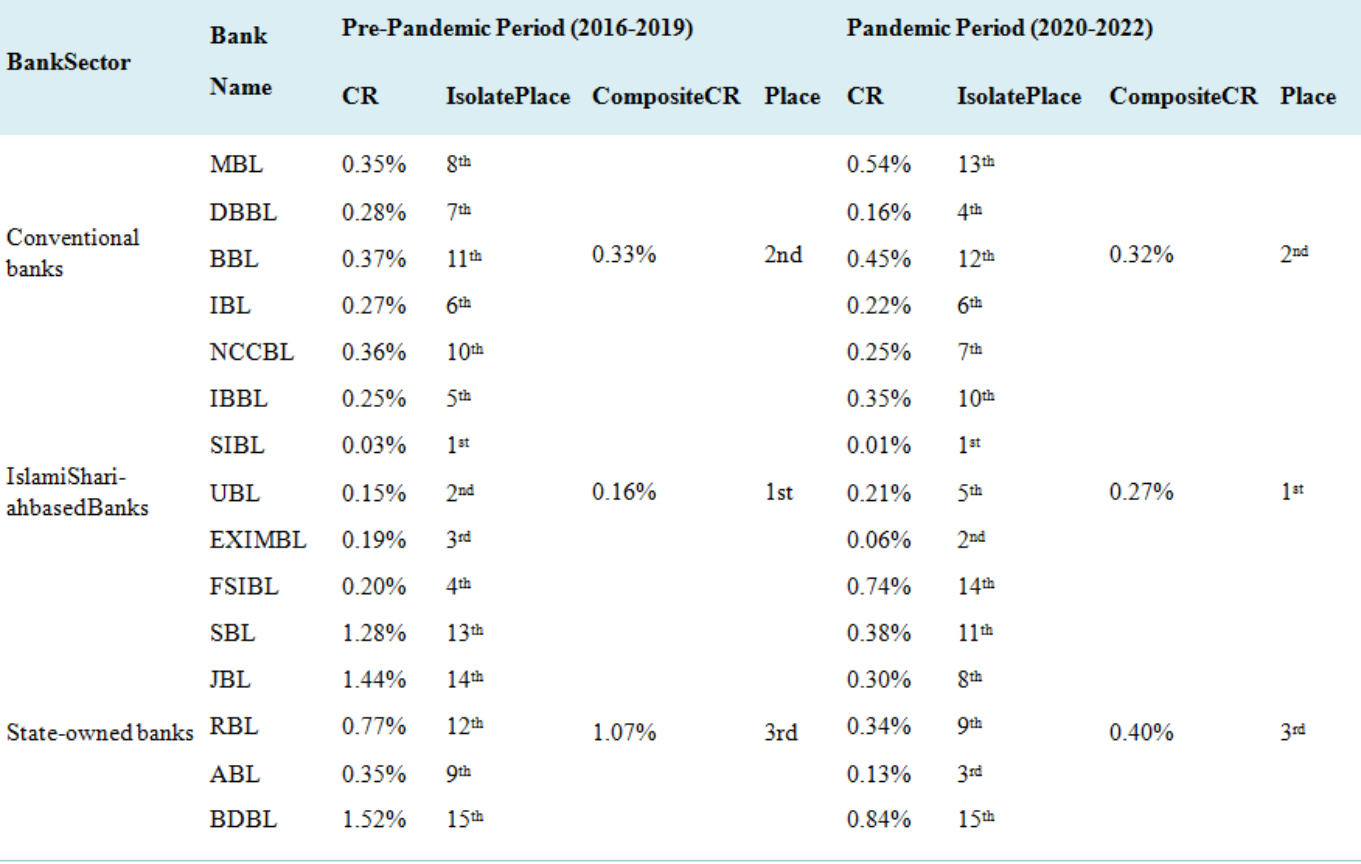

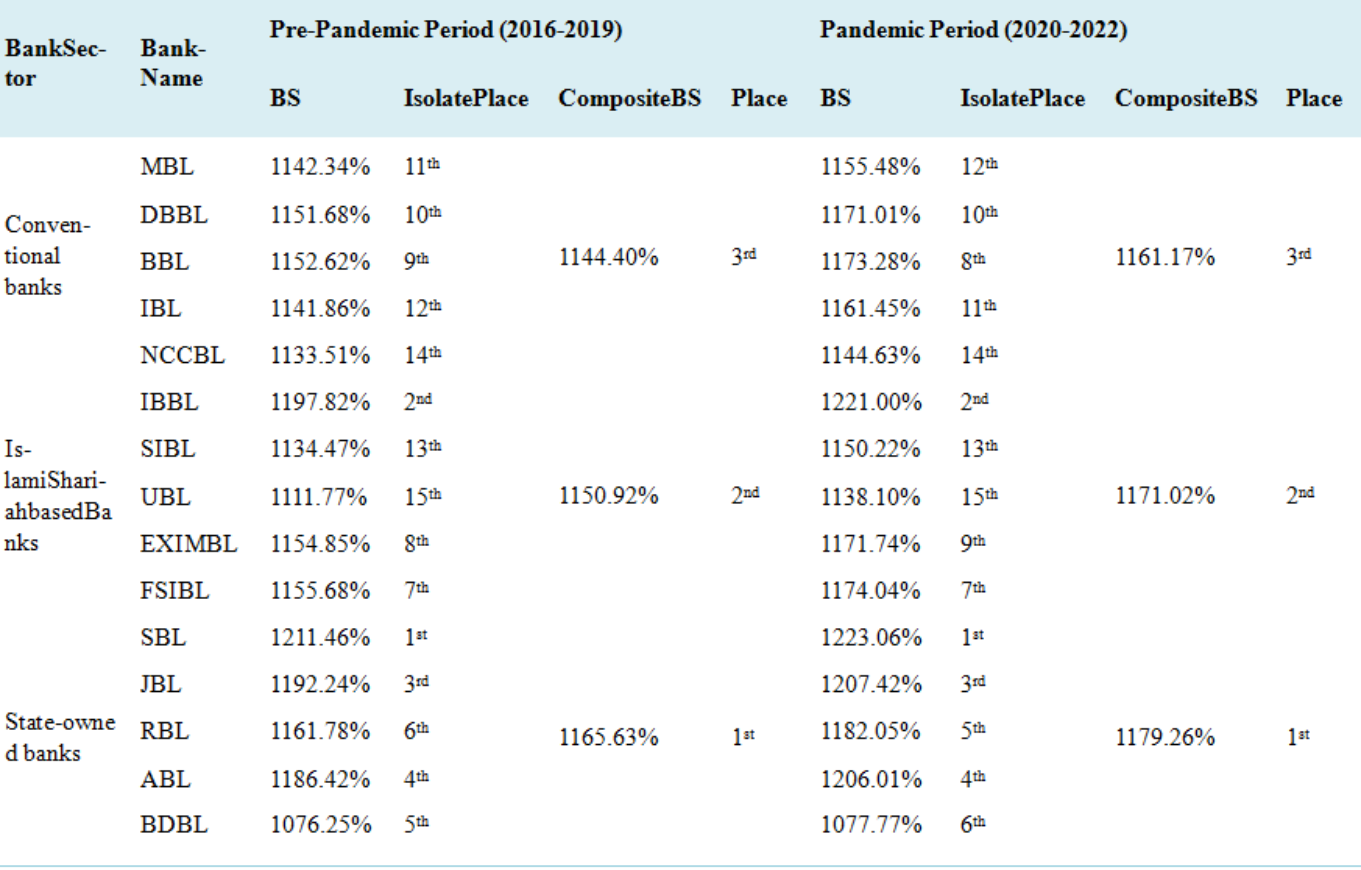

Purpose-The Russia-Ukraine conflict and 19 pandemics have severely damaged the world economy. Banking institutions are crucial to the functioning of any economy, and their financial standing is a vital indicator of the economy's stability. Any major development, be it political or economic, has an impact on the banking industry. The dollar rate's volatility and other issues hurt the GDP. Therefore, the study examines banking performance in vulnerable global situations before and during the pandemic. This study utilizes 7 years of panel data to analyze global financial crisis banking performance. Design/methodology- Eight ratios were used to compare the banks' profitability, efficiency, liquidity position, and default risk: return on asset, asset utilization ratio, operational efficiency ratio, debt to asset ratio, loan to deposit ratio, loan to asset ratio, credit risk, and bank size. The descriptive statistics show lower ROA and AUR values for banks, but a lower CR value suggests that pandemic-era borrowers will repay their loans on time. Findings – Due to their reliance on borrowed capital, banks may be more vulnerable to default and financial leverage since they lack the liquidity to meet unforeseen requirements for funds. This is indicated by the higher mean values of DAR, LDR, and LAR. Ratio analysis shows that pre-pandemic banks profited well throughout the pandemic. State-owned banks have a worse position in profitability, efficiency, and default risk but a better position in liquidity in both study periods. Conventional banks placed first in profitability, but Islamishariah-based banks placed first in efficiency, high liquidity risk, and low default risk. Originality –This study will help bank officials find the flaw and prevent it from improving financial performance and recovering from the global crisis. This may assist bank investors and depositors in choosing wisely.

| Published in | International Journal of Economics, Finance and Management Sciences (Volume 12, Issue 3) |

| DOI | 10.11648/j.ijefm.20241203.14 |

| Page(s) | 172-184 |

| Creative Commons |

This is an Open Access article, distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution and reproduction in any medium or format, provided the original work is properly cited. |

| Copyright |

Copyright © The Author(s), 2024. Published by Science Publishing Group |

Financial Performance, Global Financial Crisis, Ratio Analysis, Conventional Banks, Islami Shariah-Based Banks, State-owned Banks in Bangladesh

Conventional banks | Acronym | IslamiShariah-based banks | Acronym | State owned banks | Acronym |

|---|---|---|---|---|---|

Mercantile Bank Ltd. | MBL | Islami Bank Bangladesh Ltd. | IBBL | Sonali Bank Ltd. | SBL |

Dutch-Bangla Bank Ltd. | DBBL | Shahjalal Islami Bank Ltd. | SIBL | Janata Bank Ltd. | JBL |

BRAC Bank Ltd. | BBL | Union Bank Ltd. | UBL | Rupali Bank Ltd. | RBL |

IFIC Bank Ltd. | IBL | EXIM Bank Ltd. | EXIMBL | Agrani Bank Ltd. | ABL |

National Credit & Commerce Bank Ltd. | NCCBL | First Security Islami Bank Ltd. | FSIBL | Bangladesh Development Bank Ltd. | BDBL |

Financial performance | Ratios | Acronym | Calculation methods |

|---|---|---|---|

Profitability | Return on asset | ROA | Net income÷ Total asset |

Asset utilization ratio | AUR | Reserves for doubtful loans ÷ total loans and advances | |

Efficiency | Operating efficiency ratio | OER | Total operating expenses ÷ Net interest income |

Liquidity position | Debt to asset ratio | DAR | Total Liabilities÷ Total Assets |

Loan to deposit ratio | LDR | Total loans and advances ÷ Total deposit | |

Loan to asset ratio | LAR | Total loans and advances ÷ Total asset | |

Default risk | Credit risk | CR | Reserve for doubtful loan ÷ Total loan and advances |

Bank size | BS | Ln (Total Asset) |

Pre-Pandemic period (2016-2019) | Pandemic period (2020-2022) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Variables | N | Minimum | Maximum | Mean | Std. Deviation | N | Minimum | Maximum | Mean | Std. Deviation |

Return on asset | 60 | -.0112 | .0183 | .0065 | .00545 | 45 | .0001 | .0130 | .0052 | .00374 |

Asset utilization ratio | 60 | .01936 | .07522 | .0386 | .01344 | 45 | .017475 | .0626002 | .0328 | .01182 |

operating efficiency ratio | 60 | -4.8824 | 24.0142 | 1.457 | 3.8500 | 45 | 93.2780 | 43.53708 | -.1719 | 16.135 |

Debt to asset ratio | 60 | .66569 | .96577 | .9180 | .06853 | 45 | .655647 | .9756161 | .9242 | .07162 |

Loan to deposit ratio | 60 | .37481 | 1.1151 | .8316 | .17273 | 45 | .467148 | 1.107646 | .8632 | .15744 |

Loan to asset ratio | 60 | .30480 | .83936 | .6478 | .15701 | 45 | .369220 | .849933 | .6553 | .13720 |

Credit risk | 60 | .00005 | .03029 | .0052 | .00613 | 45 | .000009 | .0095900 | .0033 | .00273 |

Bank size | 60 | 10.7375 | 12.16834 | 11.5365 | .34303 | 45 | 10.7477 | 12.26436 | 11.7048 | .36290 |

| [1] | Agarwal, D. P., & Kassahun, Z. W. (2017). ASSESSMENT OF SERVICE QUALITY OF PUBLIC AND PRIVATE BANK IN WOLAITA SODO, ETHIOPIA: A COMPARATIVE STUDY. International Journal of Marketing & Financial Management, 33-42. |

| [2] | Ahmed, A., Sultana, M. & Karmakar, A., 2022. Uncovering the Extent of Social Responsibility of Private Commercial Banks: A Comparative Study on CSR Activities during COVID Pandemic. European Journal of Business and Management, 14(20). |

| [3] | Ahsan, M. K. (2016). Measuring Financial Performance Based on CAMEL: A Study on Selected Islamic Banks in Bangladesh. Asian Business Consortium | ABR, 47-56. |

| [4] | Akber, S. M., & Dey, A. (2020). Evaluation of the Financial Performance between Traditional Private Commercial Banks and Islamic Banks in Bangladesh. International Journal of Islamic Banking and Finance Research, 1-10. |

| [5] | Akter, A., 2023. Does intellectual capital affect bank performance? Evidence from Bangladesh. LBS Journal of Management & Research, 21(2), pp. 171-185. |

| [6] | Chakrobortty, T. and Sultana, M., Financial Inclusion for Rural Community in Bangladesh through Agent Banking. IJFMR-International Journal For Multidisciplinary Research, 5(3). |

| [7] | Das, P. C., & Noor, P. (2019). Impact of Credit Risk Management on Financial Performance: Panel Evidence from State-Owned and Private Commercial Banks in Bangladesh. THE COST AND MANAGEMENT. |

| [8] | Gazi, D. M., Talukder, M., Molla, M., Hossain, D., & Hossain, A. I. (2022). DOES THE FINANCIAL PERFORMANCE OF ISLAMIC BANKS ARE HIGHER THAN THE TRADITIONAL BANKS IN BANGLADESH? PANEL DATA ANALYSIS. Indian Journal of Finance and Banking, 33-46. |

| [9] | Gazi, M. A., Nahiduzzaman, M., Harymawan, I., Masud, A., & Dhar, B. K. (2022). Impact of COVID-19 on Financial Performance and Profitability of Banking Sector in Special Reference to Private Commercial Banks: Empirical Evidence from Bangladesh. Sustainability, 2-23. |

| [10] | Ghosh, R. & Saima, F. N., 2021. Resilience of commercial banks of Bangladesh to the shocks caused by COVID-19 pandemic: an application of MCDM-based approaches. Asian Journal of Accounting Research, 6(3), pp. 281-295. |

| [11] | Hossain, S. A., Islam, M., Mahmud, M., & Islam, K. (2017). Evaluation of Financial Performance of Commercial Banks in Bangladesh: Comparative Study Based on CAMEL Approach. The Millennium University Journal, 54-77. |

| [12] | Jha, S., & Hui, X. (2012). A comparison of financial performance of commercial banks: A case study of Nepal. African Journal of Business Management, 7601-7611. |

| [13] | Karmakar, A., Habib, S. N. & Ahmed, A., 2018. Socio-Economic Factors Affecting the Perception of Women Entrepreneurs towards Bank Loan: A Study on Rajshahi City. Asian Business Review, 8(3), pp. 105-114. |

| [14] | Karim, R. A., & Alam, T. (2013). An Evaluation of Financial Performance of Private Commercial Banks in Bangladesh: Ratio Analysis. Journal of Business Studies Quarterly, 65-77. |

| [15] | Karim, M. R., Shetu, S. A. & Razia, S., 2021. COVID-19, liquidity and financial health: empirical evidence from South Asian economy. Asian Journal of Economics and Banking, 5(3), pp. 307-323. |

| [16] | Lalon, R. M., & Naher, N. (2020). An Empirical Analysis on Liquidity Management of Commercial Banks in Bangladesh: A Comparative Study Between State-Owned and Private Commercial Banks. Journal of Economics and Business, 299-312. |

| [17] | Mohammed, S. A. S. A.-N. & Muhammed, D. J., 2017. Financial crisis, legal origin, economic status and multi-bank performance indicators: evidence from Islamic banks in developing countries. Journal of Applied Accounting Research, 18(2). |

| [18] | Moudud-Ul-Huq, S., 2020. Does bank competition matter for performance and risk-taking? empirical evidence from BRICS countries. International Journal of Emerging Markets. |

| [19] | Mubarak, D. ( 2021). AN ASSESSMENT OF FINANCIAL STABILITY OF SELECT PUBLIC AND PRIVATE SECTOR BANKS IN INDIA. UGC Care Journal, 22-36. |

| [20] | Muñoz-Mendoza, J., Yelpo, S. M., Ramos, C. L., & Fuentealba, C. L. (2020). Market Concentration and Income Diversification: Do They Always Promote the Financial Stability of Banking Industry? Finanzas y Politíca Económica, 341-365. |

| [21] | Nobi, M. N., Azhari, M. R., Islam, S., & Billah, M. (2020). Comparative Financial Position Analysis of Islamic Banking Industries: A Study of Selected Islamic Banks in Bangladesh. International Journal of Science and Business, 119-130. |

| [22] | Sultana, R., Ghosh, R. & Sen, K. K., 2022. Impact of COVID-19 pandemic on financial reporting and disclosure practices: empirical evidence from Bangladesh. Asian Journal of Economics and Banking, 6(1), pp. 122-139. |

| [23] | Varma, P., Nijjer, S., Sood, K., Grima, S., & Apoga, R. R. (2022). Thematic Analysis of Financial Technology (Fintech) Influence on the Banking Industry. Risks 2022, 10, 186, 1-17. |

APA Style

Banu, M. L. A., Karmakar, A., Afrin, K. H., Chakrobortty, T., Afrin, T. H. (2024). Banking Performance During the Global Financial Crisis: Empirical Evidence from Bangladesh. International Journal of Economics, Finance and Management Sciences, 12(3), 172-184. https://doi.org/10.11648/j.ijefm.20241203.14

ACS Style

Banu, M. L. A.; Karmakar, A.; Afrin, K. H.; Chakrobortty, T.; Afrin, T. H. Banking Performance During the Global Financial Crisis: Empirical Evidence from Bangladesh. Int. J. Econ. Finance Manag. Sci. 2024, 12(3), 172-184. doi: 10.11648/j.ijefm.20241203.14

AMA Style

Banu MLA, Karmakar A, Afrin KH, Chakrobortty T, Afrin TH. Banking Performance During the Global Financial Crisis: Empirical Evidence from Bangladesh. Int J Econ Finance Manag Sci. 2024;12(3):172-184. doi: 10.11648/j.ijefm.20241203.14

@article{10.11648/j.ijefm.20241203.14,

author = {Mosa. Layla Arzuman Banu and Anima Karmakar and Kaniz Habiba Afrin and Tamal Chakrobortty and Tasnia Husne Afrin},

title = {Banking Performance During the Global Financial Crisis: Empirical Evidence from Bangladesh

},

journal = {International Journal of Economics, Finance and Management Sciences},

volume = {12},

number = {3},

pages = {172-184},

doi = {10.11648/j.ijefm.20241203.14},

url = {https://doi.org/10.11648/j.ijefm.20241203.14},

eprint = {https://article.sciencepublishinggroup.com/pdf/10.11648.j.ijefm.20241203.14},

abstract = {Purpose-The Russia-Ukraine conflict and 19 pandemics have severely damaged the world economy. Banking institutions are crucial to the functioning of any economy, and their financial standing is a vital indicator of the economy's stability. Any major development, be it political or economic, has an impact on the banking industry. The dollar rate's volatility and other issues hurt the GDP. Therefore, the study examines banking performance in vulnerable global situations before and during the pandemic. This study utilizes 7 years of panel data to analyze global financial crisis banking performance. Design/methodology- Eight ratios were used to compare the banks' profitability, efficiency, liquidity position, and default risk: return on asset, asset utilization ratio, operational efficiency ratio, debt to asset ratio, loan to deposit ratio, loan to asset ratio, credit risk, and bank size. The descriptive statistics show lower ROA and AUR values for banks, but a lower CR value suggests that pandemic-era borrowers will repay their loans on time. Findings – Due to their reliance on borrowed capital, banks may be more vulnerable to default and financial leverage since they lack the liquidity to meet unforeseen requirements for funds. This is indicated by the higher mean values of DAR, LDR, and LAR. Ratio analysis shows that pre-pandemic banks profited well throughout the pandemic. State-owned banks have a worse position in profitability, efficiency, and default risk but a better position in liquidity in both study periods. Conventional banks placed first in profitability, but Islamishariah-based banks placed first in efficiency, high liquidity risk, and low default risk. Originality –This study will help bank officials find the flaw and prevent it from improving financial performance and recovering from the global crisis. This may assist bank investors and depositors in choosing wisely.

},

year = {2024}

}

TY - JOUR T1 - Banking Performance During the Global Financial Crisis: Empirical Evidence from Bangladesh AU - Mosa. Layla Arzuman Banu AU - Anima Karmakar AU - Kaniz Habiba Afrin AU - Tamal Chakrobortty AU - Tasnia Husne Afrin Y1 - 2024/06/13 PY - 2024 N1 - https://doi.org/10.11648/j.ijefm.20241203.14 DO - 10.11648/j.ijefm.20241203.14 T2 - International Journal of Economics, Finance and Management Sciences JF - International Journal of Economics, Finance and Management Sciences JO - International Journal of Economics, Finance and Management Sciences SP - 172 EP - 184 PB - Science Publishing Group SN - 2326-9561 UR - https://doi.org/10.11648/j.ijefm.20241203.14 AB - Purpose-The Russia-Ukraine conflict and 19 pandemics have severely damaged the world economy. Banking institutions are crucial to the functioning of any economy, and their financial standing is a vital indicator of the economy's stability. Any major development, be it political or economic, has an impact on the banking industry. The dollar rate's volatility and other issues hurt the GDP. Therefore, the study examines banking performance in vulnerable global situations before and during the pandemic. This study utilizes 7 years of panel data to analyze global financial crisis banking performance. Design/methodology- Eight ratios were used to compare the banks' profitability, efficiency, liquidity position, and default risk: return on asset, asset utilization ratio, operational efficiency ratio, debt to asset ratio, loan to deposit ratio, loan to asset ratio, credit risk, and bank size. The descriptive statistics show lower ROA and AUR values for banks, but a lower CR value suggests that pandemic-era borrowers will repay their loans on time. Findings – Due to their reliance on borrowed capital, banks may be more vulnerable to default and financial leverage since they lack the liquidity to meet unforeseen requirements for funds. This is indicated by the higher mean values of DAR, LDR, and LAR. Ratio analysis shows that pre-pandemic banks profited well throughout the pandemic. State-owned banks have a worse position in profitability, efficiency, and default risk but a better position in liquidity in both study periods. Conventional banks placed first in profitability, but Islamishariah-based banks placed first in efficiency, high liquidity risk, and low default risk. Originality –This study will help bank officials find the flaw and prevent it from improving financial performance and recovering from the global crisis. This may assist bank investors and depositors in choosing wisely. VL - 12 IS - 3 ER -